Office spaces have undergone significant transformations in 2024. The evolution of work culture, advancements in technology, and changing employee expectations are driving factors in this transition. Businesses are redesigning their offices to align with modern needs, focusing on flexibility, sustainability, collaboration, and employee wellness.

This blog focuses on the most significant workplace trends anticipated for 2024. In addition to enhancing workplace aesthetics, these office trends aim to create environments that boost productivity and improve employee well-being. Keep reading to explore how these office trends are reshaping workspaces and what this means for businesses and employees.

The Rise of Hybrid Work and How it Affects Office Space

The advent of hybrid work has had a prominent impact on the use and layout of office spaces.

As companies adjust to the concept of hybrid work, which is a blend of in-office and remote work, traditional office design changes to suit a range of work preferences and styles.

| Comfort in the Workplace |

Ergonomically designed furniture, flexible seating arrangements, adequate lighting, and dedicated quiet areas contribute to workplace comfort, which is crucial for both productivity and well-being. |

| DE&I (Diversity, Equity, and Inclusion) |

Hybrid work models have the potential to enhance workplace initiatives related to diversity, equity, and inclusion (DE&I). This inclusivity might include offering accessible workspaces, accommodating diverse time zones, and cultivating a sense of belonging where employees feel that their voices are heard and valued. |

| Women Centric |

Women can benefit from the hybrid work framework, as it allows them to achieve a better work-life balance. Remote work gives them more control over their schedules, allowing them to balance childcare responsibilities while pursuing their professional goals. |

| Startups and SMEs |

Startups and SMEs are leveraging the flexibility of hybrid work to improve office spaces, focusing on collaboration and innovative amenities while implementing cost-effective scaling and expansion solutions. |

10 Top Office Space Trends for 2024

These are the top ten workplace trends in 2024:

- Hybrid Working: The onset of the pandemic accelerated the adoption of remote work, with its impact extending well beyond the initial outbreak. The hybrid working model, which enables employees to work from home or in a traditional office setting, will still be prevalent in 2024. In addition to increasing productivity, this working model improves work-life balance and job satisfaction.

- Biophilic Designs: Studies have demonstrated that adding natural elements to office spaces improves both employee productivity and well-being. Natural light and plants are incorporated in biophilic designs to create environments that imitate outdoor spaces. These designs are known to reduce stress, increase creativity, and improve cognitiv function among employees.

- Flexible Office Space: Traditional cubicles are being replaced by more flexible designs that can adjust to changing tasks and team sizes. Modular furniture, movable partitions, and multipurpose rooms promote better flexibility and efficiency in space utilisation.

- Role Of Technology: The Internet of Things (IoT) is revolutionising workplaces, offering features like occupancy sensors for space planning, smart lighting, and collaboration tools. Apps and voice assistants streamline operations. This tech optimises efficiency and enhances employee experiences by dynamically responding to evolving needs.

- Colour And Aesthetics: Strategic decisions in colour schemes and workplace aesthetics significantly influence emotions and motivation. While vibrant colours energise, warm neutrals promote relaxation and concentration. Excellent colours, such as green and blue, bring calmness. A thoughtful design fosters a friendly atmosphere where employees can connect and grow.

- Sustainability And Eco Consciousness: To minimise their environmental impact, companies are prioritising sustainability and implementing strategies like using sustainable materials and renewable energy sources and facilitating energy-efficient operations. Other best practices include solar panels, low-emission paints, green infrastructure, motion-activated lighting, smart refill water solutions, and responsible waste management. These initiatives not only save money but also show a company’s commitment to the environment.

- Ergonomic Furniture: Due to growing health concerns, ergonomic furniture has become essential in workplaces. Adjustable desks and standing workstations improve posture and comfort while lowering the chance of muscular strains.

- Collaborative Workplace: Collaboration is at the core of modern workplace culture, inspiring the creation of collaborative workspaces that foster teamwork, creativity, and knowledge sharing. Offices featuring open floor layouts, communal areas, and collaborative tools enable teams to connect and collaborate seamlessly regardless of their physical location.

- Location: 2024 has seen an evolution in the relevance of workplace location, with a focus on accessibility, connectivity, and amenities. For companies trying to draw in top talent, proximity to public transportation, recreational facilities, and access to dining options has become crucial.

- Coworking Lounges: As the gig economy expands, coworking spaces are gaining popularity among remote workers, freelancers, and entrepreneurs seeking a dynamic and adaptable work environment. Employers are adding coworking lounges or partnering with coworking providers so that employees may use amenities, common spaces, and networking opportunities.

Emerging Technologies and How They Affect Office Environments

The list of new technologies and their effects on office spaces is as follows:

- IoT devices provide valuable data to enhance user experience. These gadgets can control temperature, lighting, and air quality and identify available meeting rooms, allowing for greater comfort and space utilisation.

- Systems that utilise Artificial intelligence (AI), such as chatbots and virtual assistants, are transforming office work by automating repetitive tasks, improving decision-making, and providing employees with personalised experiences.

- AR-enabled remote collaboration systems provide real-time communication between remote teams as if they were in the same room. This experience stimulates innovative ideas and enhances creativity. Immersion training experiences are made possible by VR simulations, which assist while onboarding new employees or rehearsing complicated procedures in a secure environment.

- Video conferencing and instant messaging tools have made remote work more popular. This trend is changing the way office spaces are designed, requiring fewer physical workstations. Virtual collaboration platforms also allow for seamless communication between teams, even across different time zones.

- Enhancing cybersecurity is essential to avoid financial losses due to data breaches. Office networks include multiple layers of security, such as strong encryption technology and advanced access control, to secure sensitive information.

- Businesses are investing in smart building solutions, such as motion-sensitive lighting and automated heating/cooling systems, to lower expenses and carbon footprints.

The Shift to Sustainability and Wellness in Flexible Office Design

The requirements and goals of modern firms and employees are evolving, which has led to a transition in flexible office design towards sustainability and well-being. Key elements of this workplace trend include the following:

| Embracing Sustainability in Office Design |

An increased awareness of environmental issues is reflected in the construction of workplaces, which are built using eco-friendly materials and energy-efficient technologies. |

| Prioritising Health and Wellness in Office Environments |

Office architecture is now adopting designs that focus on natural light, biophilic elements, and ergonomic furnishings to enhance the physical and mental well-being of employees in the workplace. |

| Envisioning the Future of Office Spaces |

The changing needs and desires of employees have brought diversity to office spaces. Modern workplaces are now eco-conscious, tech-savvy, and wellness-oriented. |

What Makes GO – Garden Office Bermondsey the Trendiest Office Space?

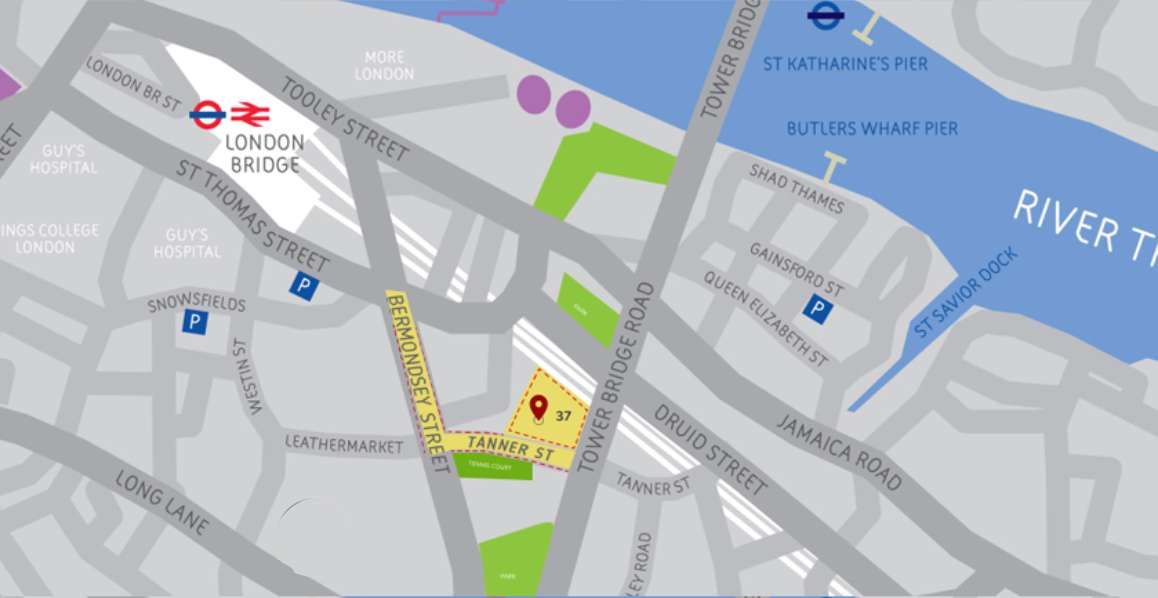

GO – Garden Office Bermondsey stands out as a highly sought-after office space, renowned for its vibrant fusion of modern architecture, state-of-the-art facilities, and bustling neighbourhood ambience. It is located close to the London Bridge tube station, and The City, Waterloo, and Westminster are all just a 15-minute ride away. The office space is housed within a fully enclosed, private garden oasis, surrounded by hanging plants and bathed by natural light. Our plug-and-play workspace is fully furnished to accommodate hybrid work patterns. We provide both wireless and wired solutions, as well as additional seating, built-in storage, a kitchen and breakout areas. Our private offices and meeting rooms have a distinctive design and cutting-edge features to accommodate all of your office space requirements. So, wait no more! Book your office space with GO – Garden Office Bermondsey today.